As the Philippines continues to navigate the effects of the COVID-19 pandemic, recent economic indicators suggest a mixed, and at times contradictory, picture of the country’s financial health.

While the Philippine Stock Exchange Index (PSEi) remained resilient around the 6,297.78 level during this period, key economic fundamentals paint a less optimistic story.

The Employment Crisis

The national employment rate dropped significantly, from 94.69% in Q1 2020 to 82.32% in Q2 2020. This sharp decline reflects the widespread hiring freeze and operational suspensions experienced during the lockdown. Simultaneously, the unemployment rate surged to 17.7%, the highest in Philippine history, equating to over 7.25 million jobless Filipinos.

These numbers are more than just statistics, they reflect the direct human cost of the pandemic’s economic impact. Many businesses, particularly in the service and hospitality industries, were either forced to shut down or reduce operations drastically.

Rising Prices, Shrinking Budgets

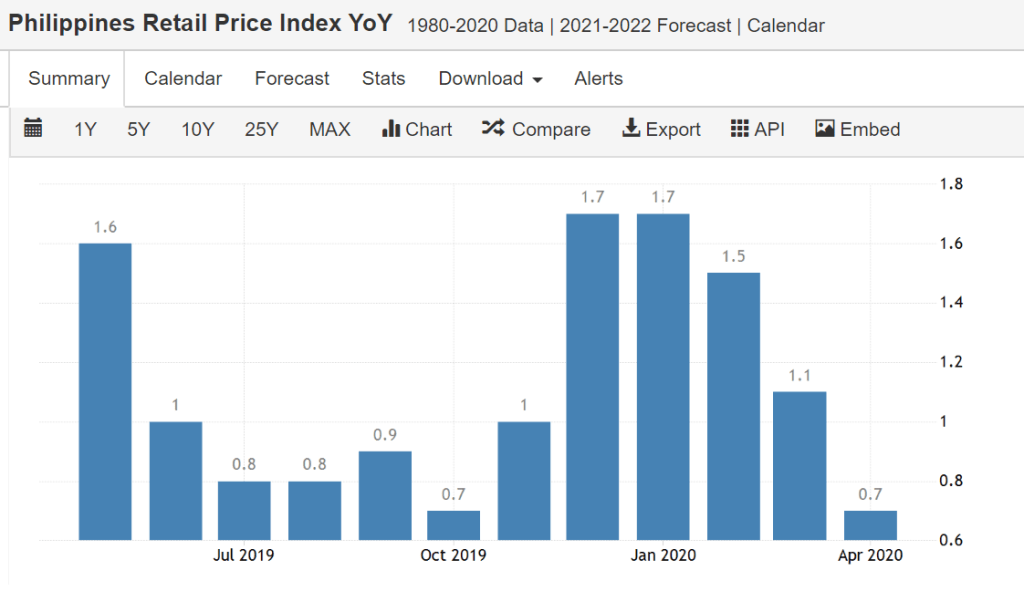

Despite weak demand and low mobility, the retail price index remained stubbornly high, particularly for essential goods such as food and beverages. This trend creates a concerning scenario: reduced income for households amid rising living costs.

The retail price index increased by 0.7% year-on-year in April 2020, marking the slowest growth since October of the previous year, but food prices continue to show an upward trend. The cost of essentials rising while many households experience income loss adds significant pressure on the average Filipino family.

Declining Consumer Confidence

Consumer sentiment also took a hit. The Consumer Confidence Index slipped to 1.26 in Q1 2020, down from 1.31 in the previous quarter. Households surveyed expressed growing concerns over price inflation and job security, especially with the uncertainty surrounding the development and rollout of a COVID-19 vaccine.

Additionally, 10-year treasury bond yields declined, signaling waning investor confidence in long-term economic stability.

On-the-Ground Insights

We’ve observed many property investors opting to exit the market, selling real estate assets, particularly condominiums, at discounted rates. Small to mid-sized businesses are either on operational pause, navigating losses, or are in the process of declaring bankruptcy.

The discrepancy between a buoyant stock market and declining economic indicators raises questions: Is this a sign of an emerging bubble? Are market valuations misaligned with economic realities?

Policy and Priorities

It is also worth noting the timing of government focus on controversial policies, such as the Anti-Terror Bill and taxation of online sellers, while COVID-19 response and economic recovery measures appeared less prioritized during this period.

While these issues dominate public discourse, economic warning signs continue to flash. As a firm, we urge stakeholders to remain alert and proactive in assessing risk and revisiting their financial strategies.

Final Thoughts

Despite all the red flags, there is always room for optimism. Historically, the Philippine economy has shown resilience. What is crucial now is clear and consistent policy direction, starting with health and safety, followed by focused economic recovery.

Our firm remains committed to supporting clients during this period of uncertainty. We continue to monitor key economic indicators and advise businesses on adaptive strategies and risk mitigation approaches tailored to today’s challenges.

We encourage everyone, whether individuals, SMEs, or large corporations, to review their financial plans and remain vigilant. In times like these, informed decisions make all the difference.

—Your Trusted Accounting and Advisory Partner

Leave a comment